E-levy: Checkout transactions to be affected and exempted

Parliament is now waiting on President Akufo-Addo to give his assent to the Electronic Transfer Levy (E-Levy) Bill.

A Majority-sided House approved the E-Levy after the Minority which has opposed the levy staged a walked out.

The Bill was adopted at a reduced rate of 1.5% from the initial 1.75%.

Parliament now awaits the President’s assent to move on with the legislation.https://c1beb338331d7b8e7e0ec0ba0f9f770b.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html

Below is a list of transactions to be affected and exempted when the implementation kicks in.

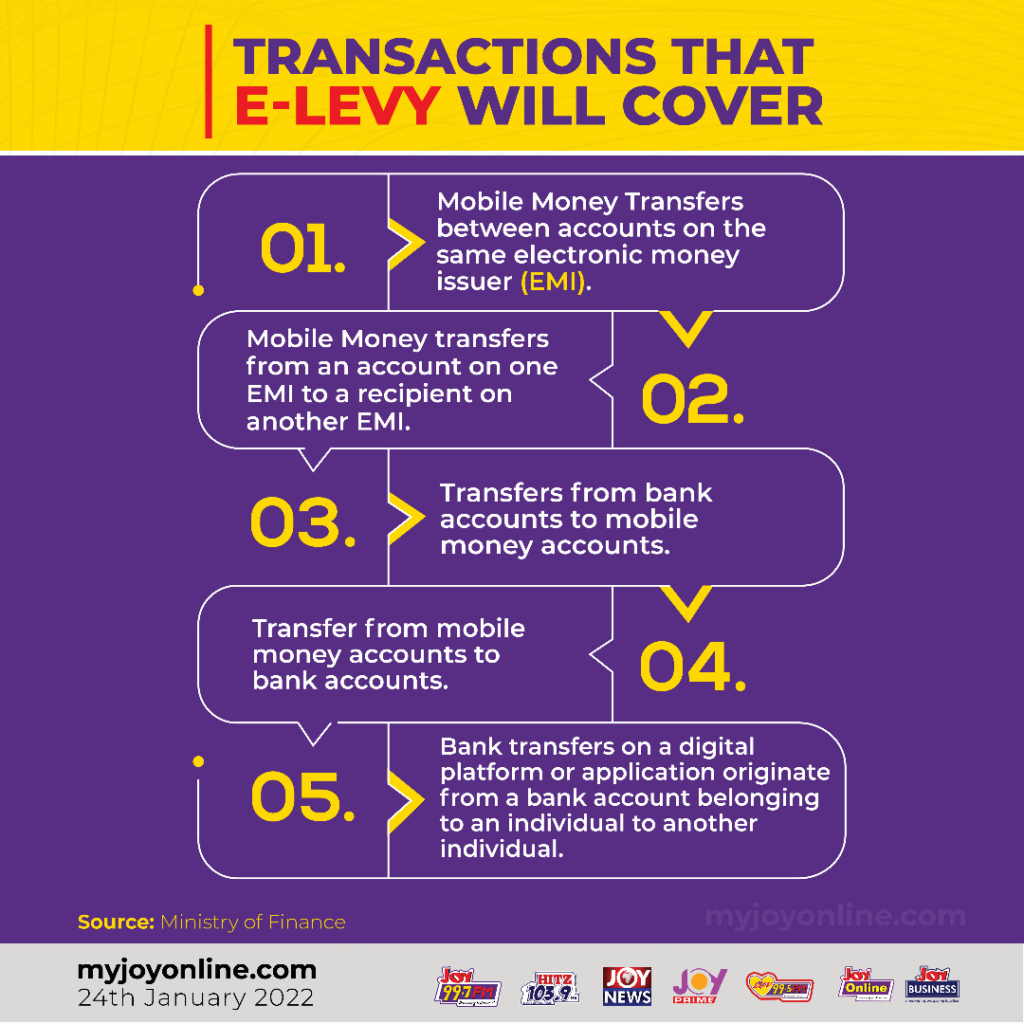

Transactions E-Levy will cover

- Mobile money transfers between accounts on the same electronic money issuer (EMI)

- Mobile money transfers from an account on one EMI to a recipient on another EMI

- Transfers from bank accounts to mobile money accounts

- Transfer from mobile money accounts to bank accounts

- Bank transfers on a digital platform or application which originate from a bank account belonging to an individual to another individual

Transactions E-Levy will NOT coverhttps://c1beb338331d7b8e7e0ec0ba0f9f770b.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html

The Finance Ministry has also highlighted some scenarios where the E-Levy will not apply. They are:

- Cumulative transfers of GHC100 per day made by the same person

- Transfers between accounts owned by the same person

- Transfers for the payment of taxes, fees and charges on the Ghana.gov platform

- Electronic clearing of cheques

- Specified merchant payments (that is, payments to commercial establishments registered with the GRA for income tax and VAT purposes)

- Transfers between principal, master agent and agent’s accounts