Dr Gideon Boako hints at new GoldBod losses in Bank of Ghana audited accounts

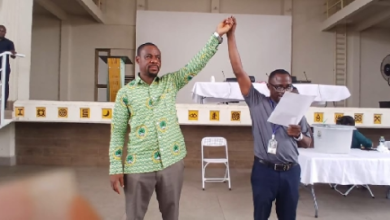

Tano North MP, Dr Gideon Boako, has suggested that additional losses linked to GoldBod could soon appear in the Bank of Ghana’s audited accounts, beyond the $214 million already reported by the IMF.

In an interview on Thursday, January 8, Dr Boako said the IMF report, dated September 2025, highlighted trading losses from the Gold for Reserve programme and associated intermediation activities.

He warned that subsequent quarters could see further losses recorded in the official accounts once the Bank of Ghana’s audit is published.

“The losses are coming from two streams,” he said. “The $214 million loss is from GoldBod’s trading activities. But there is another leg of the loss that will come up in the BoG’s audited account, and it will be higher.”

Dr Boako explained that the additional losses are connected to how the Bank of Ghana operates its cedi-dollar-gold transactions.

He criticised the current regime, under which cedis are collected from banks to purchase gold at Bloomberg rates, only to sell the resulting dollars back at the Bank of Ghana’s artificially appreciated rate.

Dr. Gideon Boako attributes this new loss to the additional six tones of gold in the bank of Ghana vault. According to him, because the central bank is currently operating a multiple exchange rate practice, a development which has been criticized by the IMF, Bank of Ghana buys the reseve gold at a higher Bloomberg rate and keeps in their vault at am artificial rate rate of 10% lower than the Bloomberg rate. This is why Dr. Boako believes strongly at the auditors of BoG will value the reserve gold at a rate lower than how much it was purchased for leading to exchange losses.

“The IMF report has said this is not good and will continue to cause more losses,” he added.

He concluded that these emerging figures reflect the policy environment rather than the operational design of GoldBod.

According to Dr Boako, without adjustments to the exchange rate regime, further financial strain on the Bank of Ghana and GoldBod is inevitable.