LIVE UPDATES: Ofori-Atta presents 2018 budget statement

The Minister for Finance, Ken Ofori Atta, is expected to present the 2018 budget statement and fiscal policy in Parliament today in which he will be seeking approval to spend some GH¢61 billion.

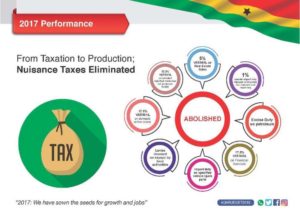

Among the highlights of the 2017 budget, were the withdrawal of the 1 percent Special Import Levy, 17.5 percent VAT/NHIL on financial services, and 17.5 percent VAT/NHIL on selected imported medicines, that are not produced locally.

The 17.5 percent VAT/NHIL on domestic airline tickets and levies imposed on kayayei by local authorities were also removed.

The 2018 budget will capture the major economic policies of government on how to speed up the country’s economic growth and consolidate the gains made in the 2017 ‘Asempa’ budget.

It is expected to capture the Northern Development Authority Bill, Middle Belt Development Authority Bill, Coastal Belt Development Authority Bill and the Zongo Development Fund Bill, which have all been passed by Parliament.

Ahead of the presentation, President Nana Addo Dankwa Akufo Addo has hinted that the budget will announce significant electricity tariff review and reduction to help boost the industrial sector.

He has also assured Ghanaians that the budget will create more jobs for the teeming youth in the country.

Minority spokesperson on Finance, Casiel Ato Forson, however, says the budget will not create jobs because the private sector is so distressed. According to him, commercial banks do not have the needed liquidity to lend to the private sector; the government was implementing austerity measures, while the Central Bank had been mandated to pursue a tight monetary policy.

Meanwhile, some economists have cautioned against ambitious oil revenue projection saying, the previous experiences must serve as a guide to government as Ghana has no control over the price of oil.

Can the 2018 budget stimulate growth? Stay with us as we bring you live updates from Parliament.

Highlights

-Jobs are here. Adwuma reba – Ofori-Atta says to end his presentation

-Development Authorities GH¢1.26 billion

– Zongo Development Fund GH¢100 million

-Integrated Bauxite Aluminum US$2 billion

-National ID GH¢200million

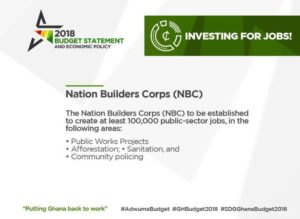

-Nation Builders Corps – 100,000 GH¢600 million

-One District One Factory GH¢40 million

-Stimulus Packages for Industrialization

-GH¢236 million

-Planting for Food and Jobs GH¢700 million

-We will massively deliver on jobs this year – Ofori-Atta

-We promised to implement a strategy to curb the menace of galamsey and we are delivering – Ofor-Atta

-Government to review the sources of funding of the NHIS to increase the revenue flow into the Fund.

-We promised to establish three development authorities, and we have delivered – Ofori Atta

-As Finance Minister lists achievements of the NPP government, the Minority heckles him again

-Gov’t aims to reduce the cost of local currency mortgage offered by banks and to encourage the use of technology to lower the cost of housing by the private sector.

-We promised to reduce taxes, and we have delivered – Ofori Atta

-We promised to restore nursing training allowances, and we have delivered – Ofori Atta

-We promised to implement a free senior high school policy and we have delivered – Ofori-Atta

-Government has started a process of setting up a broader Informal Sector Pension Scheme under the third tier of the National Pension Scheme to cover cocoa farmers among others. framework to operationalise the scheme will be developed in 2018.

-Pensions and insurance firms to be encouraged to invest in private equity, Real Estates Investment Trusts (REITs).

-Gov’t to initiate reforms to the investment guidelines of pensions, insurance and collective investment schemes to enable them support capital market growth.

-The President is committed to empowering women and creating opportunities for their participation in the job and wealth creation agenda – Ofori Atta

-The Government to strengthen the pensions, insurance and securities industries, which are the key agents of providing long term capital for the economy.the government of President Akufo-Addo is a government which delivers on its promises – Ofori-Atta

-“access to long-term funds by the private sector is not sufficient to drive accelerated economic growth of the country.” Ken Ofori-Atta

-In 2018, the Ministry will work with GET FUND to set up an education fund to enable Ghanaians make voluntary contributions to support education – Finance Minister

-Gov’t will enhance the capacity of Ghana Exim Bank to support agriculture and industrialisation for export

-Restructure the Ghana Infrastructure Investment Fund (GIIF) with the capability to mobilise foreign private capital for critical infrastructure development

-With the successful launch of the Free SHS, Government has received proposals from the public, several of which encourage the establishment of a fund to receive voluntary contributions to support education – Finance Minister

-Gov’t to launch a national development bank, with the capacity to mobilize private capital towards agricultural and industrial transformation

-Extension of National Fiscal Stabilization Levy (NFSL) and Special Import Levy (SIL) to 2019 – Ken ofori-Atta

-Government is still committed to carrying out social interventions to improve the well-being of citizens – Ken ofori-Atta

-We intend to enhance the capacity of the Ghana Exim Bank to support agriculture and industrialization – Finance Minister

-Parliamentary approval will be sought to exempt taxpayers who register and file returns within a targeted period from paying penalties and interests

-7.5% income tax on the commission of lotto marketing companies will be abolished and the 5% withholding tax on lotto prizes removed.

-Government will abolish income tax on the incomes of minimum wage earners.

-Government to review current income tax thresholds and peg tax-free threshold to the current minimum wage.

–

Government removed and reduced some taxes in 2017 to support and provide relief to individuals – Finance Minister

-To remove the incentives for people to engage in illegal lottery, the 7.5% income tax on the commission of lotto marketing will be abolished – Finance Minister

-Preferential tax rate of between 3 to 5 years will be granted after the tax holiday

-Government will, through the NEIP, grant tax holidays based on the number of persons employed by a start-up or early-stage business – Finance Minister

-Ghanaian entrepreneurs of age 35 years and below who start their own businesses to be granted tax holidays based on the number of persons employed by a start-up or early-stage business through the National Entrepreneurship and Innovation Plan (NEIP)

-Government to support Education sector in order to position Ghana as the premier higher education hub of the sub-region and to attract critical foreign direct investment into the sector

-GRA to collaborate with the Ministry of Local Government and Rural Development (MLGRD) to support the MMDAs in the assessment and collection of property taxes.

-Tax compliance measures to be applied in 2018:

-importers will be required to submit Letters of Credit (LC), guarantees or insurance cover from participating financial institutions before their goods are warehoused

-transit importers pay the duties on imports in Ghana which will be transferred to the designated destination country.

-deploy the Fiscal Electronic Device to VAT registered businesses. This will have the effect of VAT compliance and record keeping.

-Tax compliance measures to be applied in 2018:

-importers will be required to submit Letters of Credit (LC), guarantees or insurance cover from participating financial institutions before their goods are warehoused

-transit importers pay the duties on imports in Ghana which will be transferred to the designated destination country.

Measures to improve domestic resource mobilisation:

- create fiscal space by reducing budget rigidities

- broaden the tax base to rope in more tax payers into the tax net.

- improve tax compliance through the review of suspense regimes, special audits, use of fiscal electronic devices, implementation of the excise tax stamps etc

- strengthen the design and administration of property taxes

- rationalize taxation of the mining sector

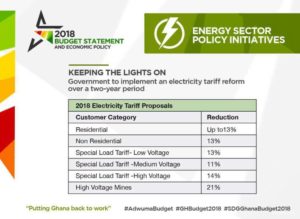

Consumers to benefit from tariff reductions

- Residential 13%

- Non Residential 13%

- Special Load Tariff- Low Voltage 13%

- Special Load Tariff -Medium Voltage 11%

- Special Load Tariff -High Voltage 14%

- High Voltage Mines 21%

-Existing 4-tier tariff classification of residential consumers will be collapsed into Lifeline and NonLifeline consumers in phases

-Finance Minister says the NPP government will ensure that electricity tariff are reduced. This corroborates the President’s earlier statement. Minority hoots at Ofori-Atta as he states that government is sending a RECOMMENDATION to PURC to that effect

-Efforts will be geared towards keeping the lights on at affordable rates to consumers, particularly industries and small businesses through reform and policy interventions over a two-year period

-Government has reviewed the tariff setting methodology and cost structure of power production which has resulted in recommendations that will be made to the PURC for consideration.

-Engaging faith-based organisations will be an effective way to expedite business development and job creation – Finance Minister

-Government to collaborate with faith-based institutions to deliver critical services in Health and Education and also to promote enterprises in the districts

-Only 10% of our gradautes currently find jobs and the Nation Builders Corp will help in solving this program. The program will be under the Office of the President.

-Gov’t to introduce a Nation Builders Corp Program to solve public service delivery in health, and other sectors to drive, amongst other things, its drive revenue mobilization.

-The program will hire 100 graduates in 2018.

-We are implementing a Nation Builders Corps to address livelihood empowerment and graduate unemployment – Finance Minister

-We will launch a major pensions scheme for cocoa farmer – Finance Minister

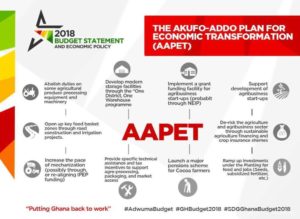

-Government aims to develop major infrastructure projects that support the agricultural zones of the country and industrialization agenda of Government. Under the Program government will:

-Ramp up investments under the Planting for Food and Jobs;

-Abolish duties on some agricultural produce processing equipment and machinery;

-Support the development of agribusiness start-ups through the establishment of a grant funding facility;

-Establish a GH¢400 million fund to de-risk the agriculture and agribusiness sector through sustainable agriculture financing and crop insurance schemes;

-Finance Minister’s list of roads to be constructed is met with different reactions. While the Minority sings the ‘ongoing’ chorus, the Majority says, ‘more roads’

4000 jobs to be created through digital address system

-Government introduced paperless transaction at the Ports, which significantly reduced transaction time and increased revenue.

-The AG will in 2018 operationalize the office to tackle the many cases of corruption that will be brought to it. The office will review contracts/deals by government departments and agencies

Finance Minister lists projects at various stages of completion.

– 4 district hospitals

– Kumawu, Fomena, Abetifi, Takoradi European Hospital

– Tamale Teaching Hospital Phase 2

– Regional & District Hospitals at Wa, Sewua, Salaga, Konongo, Tepa, Nsawkaw, Atomaic & Twifu Praso

-Office of Special Prosecutor Bill passed by Parliament is a significant move to fight corruption

-Focus of the Health Sector in 2018 is to reduce maternal mortality and improve delivery

-A report was submitted for the enactment of a law to establish a unified commission for tertiary education to deal with policy formulation, implementation and accreditation – Finance Minister

- Within the medium term, we will introduce the Basic Science, Technology, Engineering and Mathematics programme in all basic schools – Ofori-Atta

- Capitation Grant was increased by 100 percent from GH¢4.50 per capita to GH¢9.00, in to fulfillment of Government promise to make basic education free and ensure participation by all.

-Government absorbs 100% BECE registration fees

A section of the crowd in the public gallery

-Over the past 3 years, Cocobod awarded road contracts to the tune of GhC5.1 billion against a budget of GhC1.6 billion – Finance Minister

-Government has maintained the producer price of cocoa at GH¢7,600 per tonne, in spite of a 30 percent decline in international cocoa prices

Government has repaid Cocobod’s syndicated loan

-201,000 farmers have been registered for the Planting for Food and Jobs program – Finance Minister

-Planting for Food and Jobs has been a tremendous success. It recruited 2,160 university graduates and 1,070 youth to register and provide extension services – Finance Minister

-Fall Army Worm (FAW) invasion was successfully managed and kept under control. Through this intervention, 123,232ha of farm lands were recovered out of a total area of 137,479ha affected farms

-A total of 220 tractors and accessories comprising 141 maize shellers, 77 Multi-crop threshers were distributed to farmers and service providers to promote agricultural mechanization.

-In 2018, the primary balance will be grown to a larger surplus of about 1.6% of GDP from the projected 2017 outturn of 0.2% – Finance Minister

-Planting for Food and Jobs has been a success with 201000 farmers registers

-Transfers to statutory funds and other earmarked funds which are backed by law are estimated at GhC12.1 billion – Finance Minister

Tax measures being considered for 2018:

*Review of suspense regimes

*Implementation of the excise tax stamp policy

*Extension of requirement to produce tax clearance certificates

*Improve property rate collection

Finance Minister outlines

Macroeconomic Targets For The Medium Term 2018- 2021

- Real GDP to grow at an average rate of 6.2% between 2018 and 2021;

- Inflation to be within the target band of 8±2%;

- Overall fiscal deficit to remain within the fiscal rule of 3-5%;

- Primary balance is expected to improve from a surplus of 0.2% of GDP in 2017 and remain around 2.0 percent in the medium term;

- Gross International Reserves to cover at least 4 months of imports.

Macroeconomic targets are set for 2018 fiscal year:

- Overall GDP growth rate of 6.8 percent;

- Non-oil GDP growth rate of 5.4 percent;

- End period inflation rate of 8.9 percent;

- Average inflation rate of 9.8 percent;

- Fiscal deficit of 4.5% percent GDP;

- Primary balance (surplus) of 1.6 percent of GDP;

- Gross Foreign Assets to cover at least 3.5 months of imports of goods and services

-In addition to empowering GRA to bring tax evaders to book, we are investing in programs and infrastructure to widen the tax net – Finance Minister

-We will need to boost domestic revenue through innovative channels that will not place undue burden on the populace – Finance Minister

-Our fiscal program is firmly anchored on the ongoing fiscal consolidation – Finance Minister

– We have targeted a real GDP of 6.8% in 2018 and fiscal deficit of 4.5% – Finance Minister

– Our prudent debt management has improved the debt outlook and debt sustainability for Ghana – Finance Minister

– Our government, through prudent management of the economy, reduction in the fiscal deficit and debt reprofiling, reduced Ghana’s debt to GDP ratio to 68.3% as at September 2017 – Finance Minister

– Our prudent debt management has improved the debt outlook and debt sustainability for Ghana – Finance Minister

-Our government, through prudent management of the economy, reduction in the fiscal deficit and debt reprofiling, reduced Ghana’s debt to GDP ratio to 68.3% as at September 2017 – Finance Minister

-As at the end of September 2017, GNPC lifted 6 parcels of crude oil on behalf of the state – Finance Minister

- The annual average rate of debt accumulation of 36.0 percent over the last four years, has declined over the last nine months to about 13.58 percent

- “The level of naked abuse that the public purse was made to go through, Mr. Speaker we have moved on from that era” Ofori-Atta

- Through prudent management Government has been able to reduce the debt-to-GDP ratio from 73 percent at the end of December 2016 to 68.6 percent at the end of September 2017

- Total revenue and grants fell short of target by 9.3% while total expenditure fell short of target by 8.1%. This resulted in an overall fiscal deficit on cash basis of 4.6% of GDP against a target of 4.8% – Finance Minister

- As Ghanaians we are not paying our taxes and we are helping others to evade taxes – Finance Minister

- Accumulation of expenditures arrears by the previous government remains a critical challenge to achieve set targets

- Although the outturn is 9.3 percent below the budgeted target, it represents an annual growth of 16.2 percent compared to 4.1 percent during the same period in 2016-

- The BoP recorded a surplus for the first three quarters of 2017

- Total Revenue and Grants for the period amounted to GH¢28,429.2 million, equivalent to 14.1 percent of GDP compared to a target of GH¢31,346.4 million (15.5 percent of GDP)

- The cedi cumulatively depreciated by 4.42 percent as at September 2017, compared to a depreciation of 4.44 percent against the US dollar during the same period in 2016.

- Gross International Reserves (including petroleum funds and encumbered assets) stood at US$6.9 billion by end September 2017, translating into 3.9 months of import cover.

- The cedi remains relatively stable on account of an improved liquidity in the foreign exchange market – Finance Minister

- Inflation declined from 15.4 in December 2016 to 11.16

- We are returning to a robust growth after 2016 recorded the lowest growth performance in almost 2 decades – Finance Minister

- The industry sector is expected to grow by 17.7% due to increased production in oil and gas – Finance Minister

- Inflation continued to decline in 2017, mainly because of exchange rate stability, tight monetary policy and fiscal consolidation – Finance Minister

- We must create an enterrpise culture so we can transform our new found stability into a productive market

- The budget shouldn’t just be a statement to share the national cake; it should capture how the nation comes together to meet the challenges of our time – Ken Ofori Atta

- We want to energise the entrepreneurial spirit within every Ghanaian to help them earn a decent living and improve their lives – Ken Ofori Atta

- For us, the fight against poverty and unemployment is not optional; it’s a national security issue – Finance Minister

- It is time for Ghanaians to arise and build – Finance Minister

- The theme for the 2018 budget is ‘Putting Ghana Back to Work’ – Finance Minister

- Ken Ofori Atta says government will continue and invest in its key initiatives and flagship projects like Planting for Food and Jobs

- The broad agenda for next year is to translate what we have achieved into sustained growth – Finance Minister

- We are capping the statutory funds and tightening expenditure control in GIFMIS – Finance Minister

- Minority ‘heckles’ Ofori Atta at the mention of Digital Address System with a loud chorus, ‘419,419’

- Government has rolled out the destiny changing Free SHS to ensure equal opportunity for every Ghanaian child

- Maintained staiblity of the cedi against the US dollar to cedi fluctuations , Issued maiden energy bond this year.

- We resolved to be fiscally disciplined and respect the limits that Parliament set for us. I am glad to report that we are on course to end the year with the fiscal deficit of 6.5% – Finance Minister

- We have renewed confdence in the economy and maintained reliable electricity supply. Our students have forgotten what is called dumsor – Ofori Atta subtly mocks NDC

- We are ending the year with a fiscal deficit of 6.3 from 9.4 due to prudent management

- When I presented the budget in March, I indicated our commitment to take strategic steps to fix the challenges facing the economy and restore hope to Ghanaians, says Finance Minister

Source: otecfmghana.com