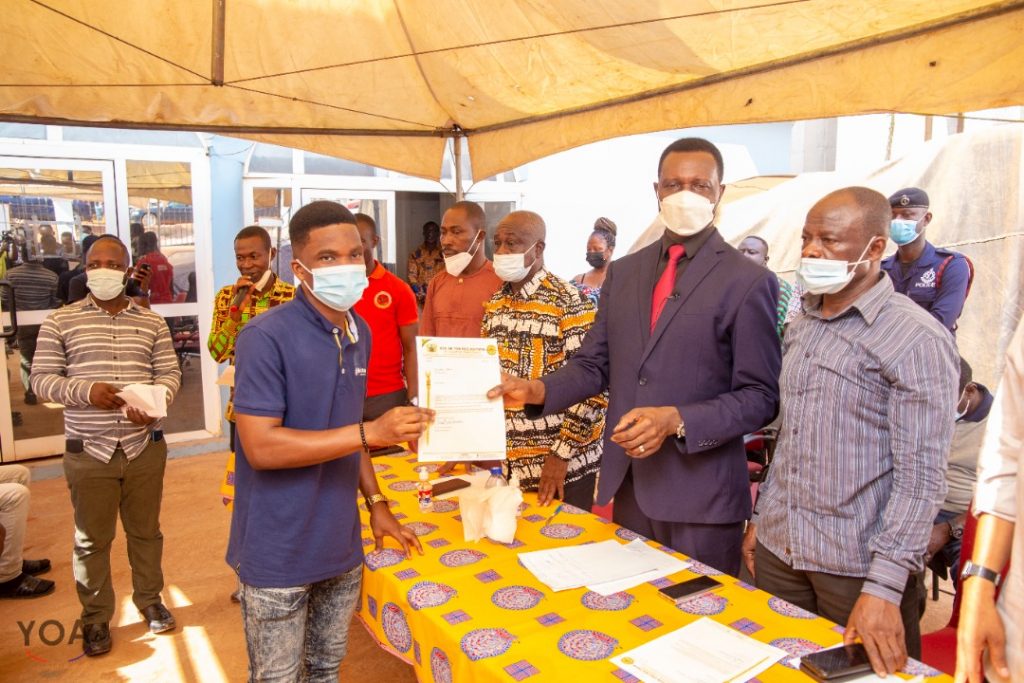

The Minister for Education and Member of Parliament (MP) for Bosomtwe, Dr. Yaw Osei Adutwum, has awarded a scholarship to 61 engineering and medical students from his constituency for the 2022 academic year.

This brings to 91 the total number of students from his constituency to receive his scholarship to pursue engineering and medicine out of his target of 100 students within 10 years.

Last year 30 students from the Bosomtwe constituency were awarded a scholarship to pursue various engineering courses at the University of Mines and Technology at Tarkwa.

Address

Speaking at a brief ceremony at Jachie in the Bosomtwe constituency to see the students off on Saturday, Dr Adutwum stressed the need for all Ghanaians to embrace science, technology, engineering and mathematics (STEM) education and take it seriously since that was the way to go now.

He explained that for the nation to catch up with the rest of the developed world, there was the need for the country to increase its quota to 60:40 in favour of STEM education as against humanities instead of the current 40:60 for STEM which held the key to industrialization and fast development that the nation was aspiring to achieve.

“We should encourage our youth to take up courses on STEM to churn out the requisite creative thinkers to address the country’s development challenges,” he said.

Huge investment

Dr Adutwum lauded the Nana Addo Dankwa Akufo-Addo for the huge investment was making towards improving the teaching and learning of STEM at various levels of education in the country.

The Education Minister said, “until the nation is able to increase its Gross Tertiary Enrolment Ratio (GTER) from the current 18.8 per cent to at least 40 per cent, it would be very difficult for the nation to develop quickly”.

According to him, this was the way to go to harness the development potential of the country, adding that, studies had shown that the accelerated growth of any society was dependent on the depth of its technocrats and scientists.

Dr. Adutwum advised the students to justify their selection for the scholarship package by studying assiduously to realize their goals in life.

“You should remember that you have your destiny in your hands,” the Minister remarked.

Scholarship package

The sponsorship which is solely from the MP personal resources comprised of school fees, accommodation and feeding as well as a laptop to each student to enhance their studies.

The Bosomtwe District Chief Executive (DCE), Mr. Joseph Kwasi Assumin, lauded the Minister for the gesture and his general contribution to educational growth in the area.

He urged the students to study hard for their own good since that was the best support ever they could get for the preparation for their future development.

Institutions of choice

The beneficiaries, made up of 53 engineering and eight medical students, and selected from various communities in the Constituency, have gained admissions to pursue medicine and engineering-related courses at various Ghanaian universities.

They include the Kwame Nkrumah University of Science and Technology (KNUST), University of Mines and Technology (UMaT), University of Energy and Natural Resources (UENR) as well as University for Development Studies (UDS).