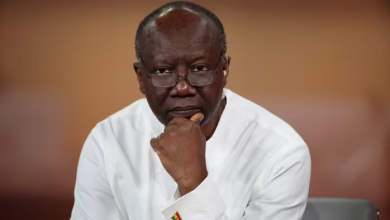

Finance Minister to deliver 2025 Mid-Year Budget review today

All eyes will today turn to Parliament as the Finance Minister, Dr. Cassiel Ato Forson, presents the much-anticipated 2025 Mid-Year Budget Review. The key question for many observers is whether government will stay within its original expenditure envelope — or request a supplementary budget to respond to fiscal and political pressures.

The review comes at a time when Ghana’s macroeconomic indicators are showing marked improvements, bolstering expectations for a policy direction that reinforces fiscal consolidation, investor confidence, and price stability.

Inflation, which began the year at 23.5 percent, declined significantly to 13.7 percent by end-June 2025. This positive disinflation trend has sparked optimism among analysts that Ghana may close the year with single-digit inflation, well ahead of the government’s original end-year target of 11.9 percent.

One of the biggest concerns for businesses and households at the start of President Mahama’s second term was the volatility of the cedi. The local currency, which traded at around GH¢15 to the US dollar on the interbank market in January, is now exchanging at approximately GH¢10.45 — marking a substantial appreciation.

This recovery has begun to reflect in marginal price adjustments in some retail outlets, while manufacturers continue to monitor the cedi’s stability within a 60-day window agreed with major business associations.

Meanwhile, on the revenue side, the removal of the betting tax has been welcomed by many. However, the new GH¢1 fuel levy introduced earlier this month has faced some public resistance. Many industry watchers are eager to see whether today’s review will include a sunset clause or timeline for its withdrawal.

In terms of economic growth, the government had earlier projected a 4.4 percent GDP growth rate for 2025. However, data from the Ghana Statistical Service indicates a stronger-than-expected 5.3 percent growth in the first quarter alone, likely paving the way for an upward revision in today’s fiscal outlook.

On the monetary front, Ghana’s gross international reserves have climbed to US$11.1 billion, enough to cover 4.8 months of imports, compared to the initial target of just three months. This represents a significant jump from the US$8.98 billion recorded at the end of 2024.

The cedi’s strong performance — having gained 42.6 percent year-to-date against the US dollar — has been attributed to improved inflows from gold and cocoa exports, remittances, and renewed investor confidence.

For many economists, the message to government is clear: while the numbers are encouraging, fiscal prudence must be sustained, especially as critical infrastructure projects begin to take shape in the second half of the year.

As the Finance Minister takes the floor, stakeholders across sectors — from investors and manufacturers to civil society and multilateral partners — will be watching closely for signals of discipline, policy credibility, and long-term economic direction.